New Research Indicates Pandemic as Tipping Point for Investment in ESG and Sustainability

|

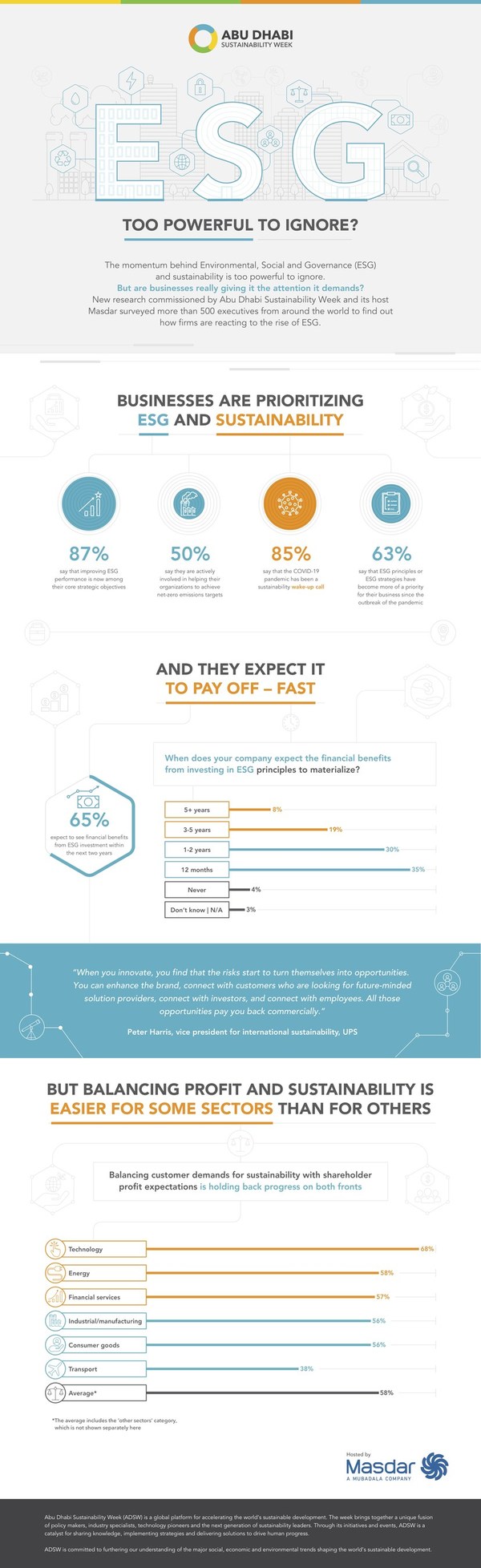

- 85 percent of respondents saw the COVID-19 pandemic as a 'wake-up call' on sustainability

- 65 percent expect to realize financial benefits of ESG investment within the next two years

- Half of all respondents say they are prioritizing ESG because it is important to investors

- Balancing profit with sustainability is easier for some sectors than for others, with technology leading and transport lagging

ABU DHABI, UAE, April 29, 2021 /PRNewswire/ -- Abu Dhabi Sustainability Week (ADSW), the global platform for accelerating sustainable development and its host Masdar, have today released the results of a global survey, which explores how businesses around the world are responding to Environmental, Social and Governance (ESG) in the wake of COVID-19.

ESG Beyond Tipping Point[1] surveyed 525 executives from global businesses that deliver annual revenues of $250 million USD or more, suggests that the COVID-19 pandemic is having a profound impact on businesses' perceptions of ESG issues.

The research found that 87 percent of respondents indicated that ESG performance is now one of their organization's core strategic objective, while 85 percent saw the COVID-19 pandemic as a wake-up call on sustainability.

Many businesses anticipate that the pay-offs from strengthening ESG activities in their organization, or in the case of financial services companies incorporating ESG data into their decision-making, will accrue quickly. The research found that, 65 percent of respondents expect to realize the financial benefit of ESG investment within the next two years, including 35 percent who expect it within the next 12 months.

Yousef Ahmed Baselaib, Executive Director, Strategy & Corporate Development at Masdar, said: "ESG has always been part of the Masdar's DNA and continues to be as the company delivers on its mandate of seeking quality investments in renewable energy and sustainable technologies. Fifteen years on since Masdar was formed, ESG has reached enough of a critical mass across all sectors that it is unlikely that we will see a return to the old profits-above-all models of the past. As we explored during Abu Dhabi Sustainability Week earlier this year, the opportunities presented by the Green Recovery will further fuel investor appetite for backing smart, sustainable companies. Those companies that ignore ESG will lose their relevance in the post-COVID era."

Shareholders are a driving force for ESG investment across sectors and regions. Nearly half of all respondents (49 percent) say they are prioritizing ESG because it is important to investors.

The research also provided deep insights on how different geographical regions and industry sectors are responding to the demand for greater ESG commitments. The research found that 70 percent of respondents from Asia-Pacific agreed that their company is committed to achieving net-zone emission, while only 33 percent of respondents from the Middle East agreed when asked the same question.

At a sector level, the research found that balancing profit with sustainability is easier for some sectors than for others, with 68 percent of respondents from the technology sector agreeing they were able to balance customer demands for sustainability with shareholder expectations for profits. However, responses from the transport sector were much lower, with only 38 percent agreeing that the sector was able to balance customer demand and shareholder expectations.

The ESG research was supported by a series of high-level interviews with industry leaders, including Dietmar Siersdorfer, Managing Director of Middle East and UAE at Siemens Energy, who said: "It is extremely gratifying to see the topics around ESG and sustainability draw more mainstream recognition. These issues need to recognized not just as a showpiece of corporate strategy but as a fundamental necessity of doing business. As a company founded to drive the energy transition and promote ESG and sustainability values, Siemens Energy has set an ambitious target of net zero emissions by 2030. We are dedicated to energizing society in line with the UN's Sustainable Development Goals, to ensure the highest impact on societal development."

At an employee level, businesses cannot overlook the growing role of sustainability in the battle to recruit and retain high quality talent at all levels of the company. The extent to which a company embraces ESG is becoming a crucial factor in whether people want to work for them – even more than remuneration policies for some. Strikingly, 52 percent of respondents say they would be prepared to take a pay cut to move to a company with a better ESG performance.

More than half of the respondents (51 percent) intend to create new ESG-focused management positions in the next 12 months, with organizations based in Asia-Pacific and the Middle East & Africa leading the way in this area.

Even before the pandemic, sustainability was rising up the corporate agenda, but this trend has accelerated dramatically during the crisis: improved ESG performance is now a core strategic objective for most organizations.

Crucially, the determination to embrace ESG principles is shared by all stakeholder groups, including investors, employees, customers and suppliers. And those organizations that are rising to the challenge are already beginning to see returns.

With business leaders now recognizing that we have moved past the tipping point: ESG is now a key battleground in the competition for investment and talent – and, ultimately, to attract and retain customers.

About the Research

The research was undertaken by Abu Dhabi Sustainability Week and its host Masdar, and in partnership with the research house Longitude.

The research surveyed 525 respondents, which represented businesses that deliver revenues of $250 million USD of more and included the following sectors; energy, transport, financial services, manufacturing and industry, consumer products and technology.

The research is supported with qualitative interviews with industry leaders from Mubadala Investment Company, Virgin Hyperloop, UPS, Unilever, 3M, and Siemens Energy.

About Abu Dhabi Sustainability Week

Abu Dhabi Sustainability Week is a global platform for accelerating the world's sustainable development. The week brings together a unique fusion of policy makers, industry specialists, technology pioneers and the next generation of sustainability leaders. Through its initiatives and events, ADSW is a catalyst for sharing knowledge, implementing strategies and delivering solutions to drive human progress.

ADSW is committed to furthering our understanding of the major social, economic and environmental trends shaping the world's sustainable development.

About Masdar

Abu Dhabi's renewable energy company Masdar is advancing the commercialization and deployment of renewable energy, sustainable urban development and clean technologies to address global sustainability challenges. Wholly owned by Mubadala Investment Company, the strategic investment company of the Government of Abu Dhabi, our mandate is to help maintain the UAE's leadership in the global energy sector, while supporting the diversification of both its economy and energy sources for the benefit of future generations. Today, Masdar is active in more than 30 countries, including the UAE, Jordan, Saudi Arabia, Mauritania, Egypt, Morocco, the UK, the US, Australia, Spain, Serbia, India, Indonesia, Uzbekistan, and many more.

References

- ^ ESG Beyond Tipping Point (abudhabisustainabilityweek.com)

Read more https://www.prnasia.com/story/archive/3357409_AE57409_0