There's fewer of us in it, but for those who are, it's worse

- Written by Ben Phillips, Associate Professor, Centre for Social Research and Methods, Director, Centre for Economic Policy Research (CEPR), Australian National University

The good news from new research conducted by the Australian National University for Social Ventures Australia and the Brotherhood of St Laurence is that fewer of us[1] are in severe financial stress, by which we mean missing meals, seeking help from charities or being unable to heat our homes.

The bad news is that for certain types of households the proportion in stress is growing, and for many the stress is getting worse.

It is well documented[2] that JobSeeker households are faring poorly with high rates of poverty but less well documented that other working age households are also suffering from high financial stress.

We have used as a measure of severe stress answers to questions in the Bureau of Statistics household expenditure surveys in 1998, 2003, 2009 and 2015 about seeking assistance from charities, going without meals, and the ability to pay bills.

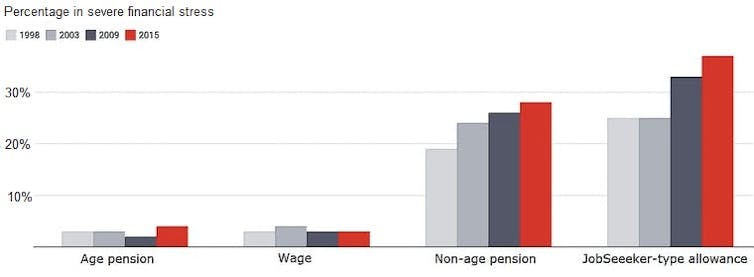

For households headed by wage earners and for age pensioners, financial stress remains low.

For households headed by recipients of non-age pensions such as disability, carers’ and single parent payments, and for households headed by Australians on unemployment and related benefits, the proportion in stress has been climbing.

Severe financial stress by source of income

ANU Centre for Social Research and Methods[3] Around 37% — more than one in three — households headed by Australians on allowances were in severe financial stress in 2015, up from one in four in 1998. Twenty eight per cent of households headed by working-age pensioners were severely financially stressed, up from 19%. The difference between a working-age pension and an allowance is that pensions are usually paid to people who aren’t expected to return to work for some time. Read more: There are lots of poverty lines, and JobSeeker isn't above any of them[4] Allowances such as JobSeeker (previously Newstart) and Youth Allowance are usually paid to people who are expected to return to work, and are typically lower. The reason households headed by both working-age pensioners and recipients of allowances are falling behind are complex. Those on allowances struggle with incomes that climb only in line with the consumer price index[5] and so until recently[6] have not increased in real terms for more than 25 years. Income matters, and the type of family Working-age pensioners have suffered from higher housing costs, limited liquid assets and tighter eligibility requirements which has meant those who have received working age pensions have been worse off. Among households headed by age pensioners and wage earners, the incidence of financial stress was much lower, at 4% and 3%. Severe financial stress by family type

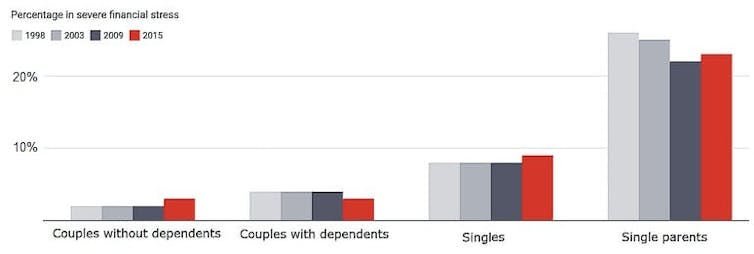

ANU Centre for Social Research and Methods[3] Around 37% — more than one in three — households headed by Australians on allowances were in severe financial stress in 2015, up from one in four in 1998. Twenty eight per cent of households headed by working-age pensioners were severely financially stressed, up from 19%. The difference between a working-age pension and an allowance is that pensions are usually paid to people who aren’t expected to return to work for some time. Read more: There are lots of poverty lines, and JobSeeker isn't above any of them[4] Allowances such as JobSeeker (previously Newstart) and Youth Allowance are usually paid to people who are expected to return to work, and are typically lower. The reason households headed by both working-age pensioners and recipients of allowances are falling behind are complex. Those on allowances struggle with incomes that climb only in line with the consumer price index[5] and so until recently[6] have not increased in real terms for more than 25 years. Income matters, and the type of family Working-age pensioners have suffered from higher housing costs, limited liquid assets and tighter eligibility requirements which has meant those who have received working age pensions have been worse off. Among households headed by age pensioners and wage earners, the incidence of financial stress was much lower, at 4% and 3%. Severe financial stress by family type  ANU Centre for Social Research and Methods[7] Twenty three per cent of households headed by single parents were in severe stress, compared to 3% of households headed by partnered parents. Financial stress was at its most acute in households with children aged under five. A lower 9% of single person households and 3% of couple-only households were in severe financial stress. Renters better off, but still badly off Renter households are much more likely to be in financial stress than homeowner households, but the proportion in severe stress has fallen from 15% to 12% Severe financial stress by housing tenure

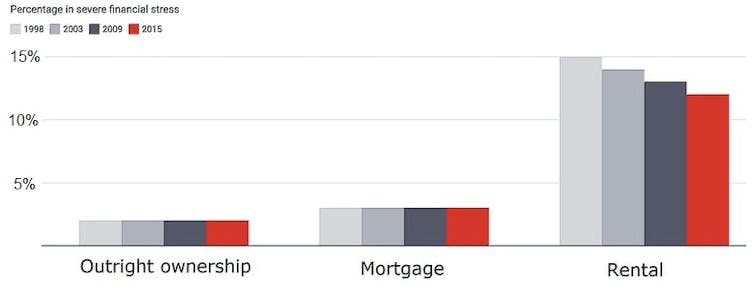

ANU Centre for Social Research and Methods[7] Twenty three per cent of households headed by single parents were in severe stress, compared to 3% of households headed by partnered parents. Financial stress was at its most acute in households with children aged under five. A lower 9% of single person households and 3% of couple-only households were in severe financial stress. Renters better off, but still badly off Renter households are much more likely to be in financial stress than homeowner households, but the proportion in severe stress has fallen from 15% to 12% Severe financial stress by housing tenure  ANU Centre for Social Research and Methods[8] Beyond these broad brush observations, we find considerable unexplained variation in financial stress. That might be because some households are better at managing money than others and some are more risk averse. When we run our findings through our model[9] of the social security and tax system we find that while small increases in working-age payments would decrease the severity of financial stress, they wouldn’t do much to reduce the incidence of it. A big increase in the overall social security budget would do a lot. An increase of 10% could allow JobSeeker to increase from the current $620 per fortnight to $996 and disability support payments to increase from $953 per fortnight to $1060 and other working-age pensions to increase by similar amounts. Other payments would remain unchanged. Read more: As one gets out, another gets in: thousands of students are 'hot-bedding'[10] Our modelling shows that while increases to other payments could also lower severe financial stress, money spent on them would have less effect. The scenario of a 10% increase in the social security budget that we put forward would cut the rate of severe financial stress among JobSeeker households by 16%. The high rates of financial stress among households supported by working age payments is largely a policy choice. Extra money wouldn’t solve all of their problems but a decent safety net would go a long way.

ANU Centre for Social Research and Methods[8] Beyond these broad brush observations, we find considerable unexplained variation in financial stress. That might be because some households are better at managing money than others and some are more risk averse. When we run our findings through our model[9] of the social security and tax system we find that while small increases in working-age payments would decrease the severity of financial stress, they wouldn’t do much to reduce the incidence of it. A big increase in the overall social security budget would do a lot. An increase of 10% could allow JobSeeker to increase from the current $620 per fortnight to $996 and disability support payments to increase from $953 per fortnight to $1060 and other working-age pensions to increase by similar amounts. Other payments would remain unchanged. Read more: As one gets out, another gets in: thousands of students are 'hot-bedding'[10] Our modelling shows that while increases to other payments could also lower severe financial stress, money spent on them would have less effect. The scenario of a 10% increase in the social security budget that we put forward would cut the rate of severe financial stress among JobSeeker households by 16%. The high rates of financial stress among households supported by working age payments is largely a policy choice. Extra money wouldn’t solve all of their problems but a decent safety net would go a long way. References

- ^ fewer of us (csrm.cass.anu.edu.au)

- ^ documented (csrm.cass.anu.edu.au)

- ^ ANU Centre for Social Research and Methods (csrm.cass.anu.edu.au)

- ^ There are lots of poverty lines, and JobSeeker isn't above any of them (theconversation.com)

- ^ in line with the consumer price index (theconversation.com)

- ^ recently (theconversation.com)

- ^ ANU Centre for Social Research and Methods (csrm.cass.anu.edu.au)

- ^ ANU Centre for Social Research and Methods (csrm.cass.anu.edu.au)

- ^ model (theconversation.com)

- ^ As one gets out, another gets in: thousands of students are 'hot-bedding' (theconversation.com)

Authors: Ben Phillips, Associate Professor, Centre for Social Research and Methods, Director, Centre for Economic Policy Research (CEPR), Australian National University