The sackings at Rio look like a victory for shareholders, but...

- Written by Andrew Linden, Sessional Lecturer, PhD (Management) Candidate, School of Management, RMIT University

In the coming days thousands of (digital) column inches are going to be devoted to the idea that institutional shareholders[1] acted decisively to force the resignation of Rio Tinto chief executive Jean-Sebastien Jacques and two others responsible for the destruction of the Juukan Gorge caves.

However the resignations[2] mask a deeper failure of institutional investors to take action over governance problems. Rio Tinto (and its predecessor companies CRA and Comalco) has a chequered history in indigenous relations, labour relations, foreign bribery and interference in politics. It was even blacklisted[3] by Norway’s sovereign wealth fund for a decade over its environmental record.

Despite these problems, and a long record of aggressive political lobbying, Australian institutional shareholders have loved Rio for its high and consistent dividends. Rio Tinto shares are held by many pension funds and in many cases even make the grade for their ethical investment options[4].

Read more: Corporate dysfunction on Indigenous affairs: Why heads rolled at Rio Tinto[5]

Period of active engagement with traditional owners under former chief Leon Davis have also obscured a legal regime that suits Rio’s aggressive pursuit of its interests.

Australian National University emeritus professor Jon Altman, who has researched land rights and native title for more than 40 years, told the Senate inquiry into the blast that all governments in Australia were to some extent captured[6] by the mining industry, whose shareholders were largely foreign:

in making these observations, I am not suggesting that multinational corporations like Rio Tinto and BHP and others have operated outside the letter of the law. What I am saying is that they have been far too influential in shaping the law to suit their instrumental extractive profit-seeking interests.

That influence extended to the West Australian legislation Rio used to get approval to dynamite the caves. The law was so one sided that that the indigenous land-owners didn’t know the approval to destroy the caves was being activated by Rio until the eleventh hour.

Rio’s first reaction to complaints was to brief its lawyers[7].

Shareholders vent, but rarely divest

Shareholders might have vented, but they didn’t divest. Even as news emerges of other significant sites are under threat[8] it is unlikely that the big funds with shares in Rio will sell them, or sell shares in other listed mining companies.

Research shows investors don’t consistently use their voices[9] to lobby firms to tackle social issues, even though there’s always talk about how they are going to.

Read more: Vital Signs: No, we won't change the corporate world with divestment and boycotts[10]

What institutional investors are more interested in, as AMP’s second-biggest shareholder Allan Gray Funds Management recently conceded, is “protecting their existing investment[11]”.

They are “conflicted” between on the one hand wanting their company to operate better, and on the other, not wanting to reduce returns.

Social licence is a Trojan horse

Rio and the mining industry must be hoping the resignations are a circuit breaker that derails any momentum to change the laws that give them cover.

They are probably hoping the community latches on to the concept of a social licence to operate[12] – the idea that so long as they behave well, they get the right to keep laws that don’t require them to.

Read more: Social licence: the idea AMP should embrace now David Murray has left the building[13]

That would be ironic, given that the mining industry invented and promoted[14] the concept of a social licence in the early 2000s in order to convince the community they could regulate themselves.

For all the sound and fury, the three executives will be paid handsomely to walk the plank.

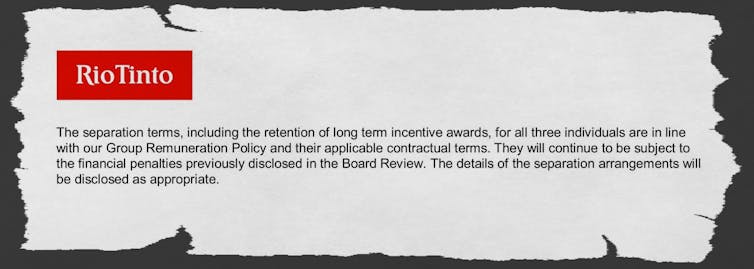

Buried at the bottom of Rio’s announcement to the ASX[15] is the news Rio Tinto chief executive and JS Jacques and the two other executives get to keep their financial packages.

Rio Tinto announcement to ASX[16]

Rio Tinto announcement to ASX[16] References

- ^ institutional shareholders (www.smh.com.au)

- ^ resignations (www.asx.com.au)

- ^ blacklisted (www.smh.com.au)

- ^ ethical investment options (www.smh.com.au)

- ^ Corporate dysfunction on Indigenous affairs: Why heads rolled at Rio Tinto (theconversation.com)

- ^ captured (cdn.theconversation.com)

- ^ brief its lawyers (www.theguardian.com)

- ^ other significant sites are under threat (www.abc.net.au)

- ^ don’t consistently use their voices (onlinelibrary.wiley.com)

- ^ Vital Signs: No, we won't change the corporate world with divestment and boycotts (theconversation.com)

- ^ protecting their existing investment (www.abc.net.au)

- ^ social licence to operate (www.investopedia.com)

- ^ Social licence: the idea AMP should embrace now David Murray has left the building (theconversation.com)

- ^ invented and promoted (www.smh.com.au)

- ^ to the ASX (www.asx.com.au)

- ^ Rio Tinto announcement to ASX (www.asx.com.au)

Authors: Andrew Linden, Sessional Lecturer, PhD (Management) Candidate, School of Management, RMIT University

Read more https://theconversation.com/the-sackings-at-rio-look-like-a-victory-for-shareholders-but-146004