CPA Australia: Most Indonesian small businesses expect to grow in 2023

- The vast majority of small businesses expect to grow in 2023.

- Almost one-quarter embracing green and sustainable finance opportunities.

- Accessing external finance remains a challenge for businesses.

JAKARTA, INDONESIA - Media OutReach - 2 May 2023 - Eighty-four per cent of Indonesian small businesses expect to grow in 2023, the second highest result for the Asia-Pacific region, a new survey shows.

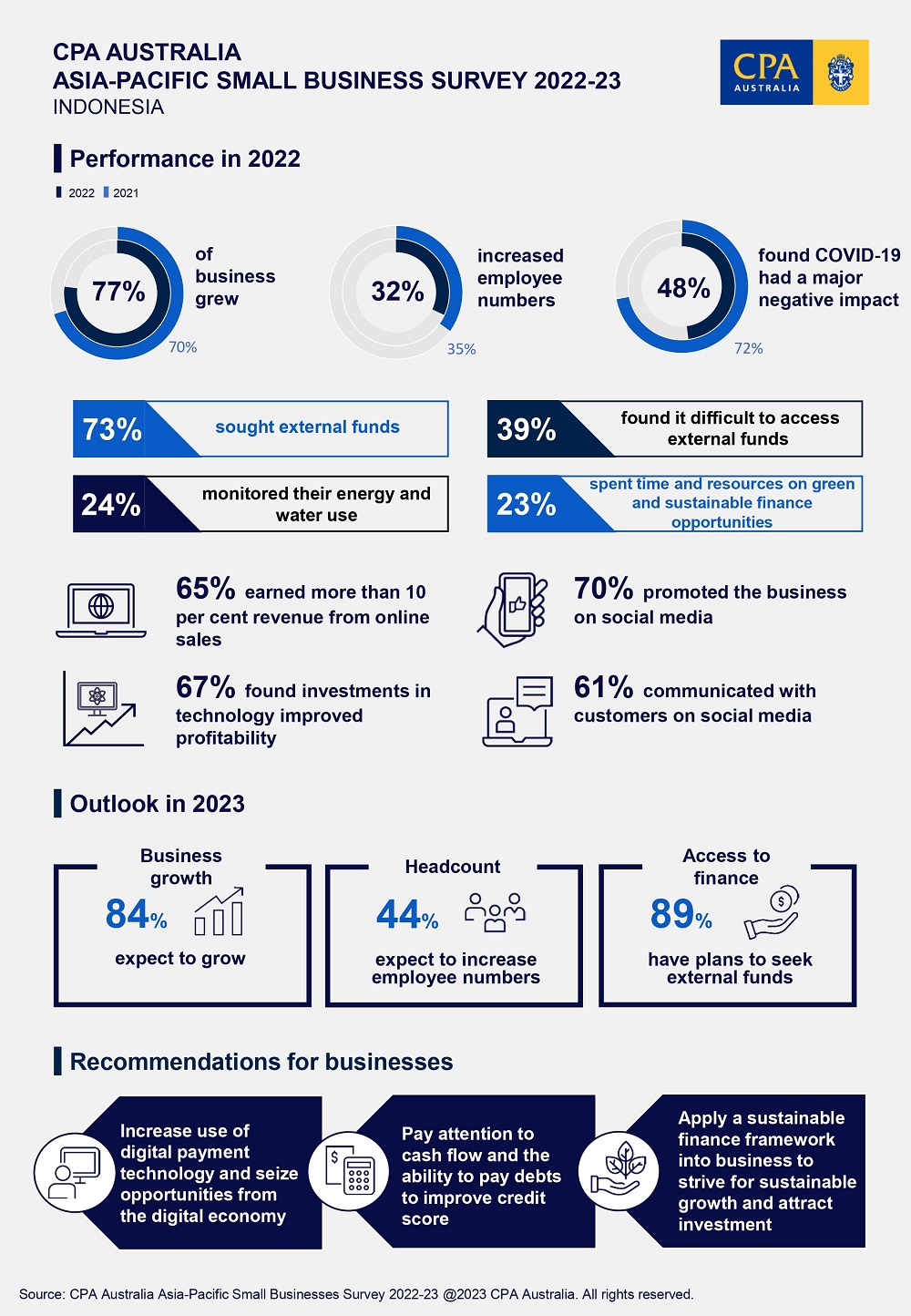

CPA Australia's Asia-Pacific Small Business Survey reveals that Indonesian small businesses remained among the most positive across Asia-Pacific in 2022. The survey covered responses from 4280 small business owners or managers across 11 Asia-Pacific markets, including 306 from Indonesia. Seventy-seven per cent reported growing in 2022 and 32 per cent hired more employees. This year is expected to be even stronger with more than four-in-10 planning to hire more staff.

Dr Adi Budiarso FCPA (Aust.), Chairman of CPA Australia's Indonesia Advisory Committee said micro, small and medium enterprises (MSMEs) were resilient amid global uncertainty. Dr Budiarso is Director of the Financial Sector Policy Centre at Indonesia's Ministry of Finance.While 48 per cent of Indonesian small businesses said COVID-19 was a major challenge, this was a drop from 72 per cent in 2021.

"Indonesia is home to more than 64 million MSMEs, creating a significant number of jobs and contributing to the economy. Although the pandemic still casts a shadow over Indonesia, its impact is diminishing. The lifting of travel restrictions has helped Indonesian small businesses perform, by boosting the tourism industry and private consumption."

Sixty-seven per cent of businesses said technology investments made last year improved their profitability. The adoption of online tools is also prevalent. Social media is used by seven-in-10 to promote their business and 61 per cent use it to communicate with customers.

"The government's National Economic Recovery Program and the Proud of Indonesian Products Movement has contributed to technology adoption across Indonesia's MSMEs. The pandemic prompted businesses to embrace technology and adapt. Indonesian businesses have a strong focus on improving customer satisfaction, becoming sophisticated at using social media to stay connected."

Sixty-five per cent of businesses received more than 10 per cent of sales through digital payment. This was lower than the survey average of 74 per cent.

"With digital payment options closely associated with high growth businesses, we hope more Indonesian small businesses will offer such payment options."

While most of Indonesia's small businesses are growing, many found accessing external finance difficult. Among the 73 per cent that sought funds last year, 39 per cent found it difficult. This was higher than the survey average of 33 per cent. In spite of this, intentions to access finance remain strong, with 89 per cent planning to seek external funds this year.

"Accessing financing is still challenging to many in developing economies including Indonesia. The pandemic may have exacerbated difficulties due to cashflow problems."

"The government has been trying to improve financial inclusion. For example, increasing access to finance through digital platforms, encouraging financing through People's Business Credit (KUR) and Ultra Micro (UMi) Financing programs and offering mentoring. MSMEs should also try to improve their solvency as this may impact their future credit score. They must keep a close eye on cashflow and costs."

The survey findings reveal that many Indonesian small businesses have spent time and resources on environmental, social and governance (ESG) practices. Twenty-four per cent monitored their energy and water use and 23 per cent adopted green and sustainable finance opportunities.

"MSMEs are crucial contributors to achieving Indonesia's climate and clean energy goals. Indonesia has established a comprehensive framework for sustainable finance to meet these goals and MSMEs should consider applying this to their business."

Hashtag: #CPAAustralia #SME #Business #Economics

The issuer is solely responsible for the content of this announcement.

About CPA Australia

CPA Australia is one of the largest professional accounting bodies in the world, with more than 172,000 members in over 100 countries and regions, including more than 21,000 members in South-East Asia. Our Indonesian office, located in Jakarta, opened in 2011. Our core services include education, training, technical support and advocacy. CPA Australia provides thought leadership on local, national and international issues affecting the accounting profession and public interest. We engage with governments, regulators and industries to advocate policies that stimulate sustainable economic growth and have positive business and public outcomes. Find out more at cpaaustralia.com.au