CPA Australia: Indonesian small businesses champion of business growth in APAC amid pandemic threats

JAKARTA, INDONESIA - Media OutReach - 8 April 2022 - Despite being hit hard by COVID-19 in 2021, Indonesian small businesses still managed to outperform their Asia-Pacific counterparts in business growth, in part due to their high level of e-commerce adoption.

They are likely to maintain this momentum in 2022, according to CPA Australia, one of the world's largest accounting bodies.

CPA Australia's 13th Asia-Pacific Small Business Survey surveyed 4,252 small business owners or managers, including 301 from Indonesia, across 11 Asia-Pacific markets to understand business conditions and confidence.

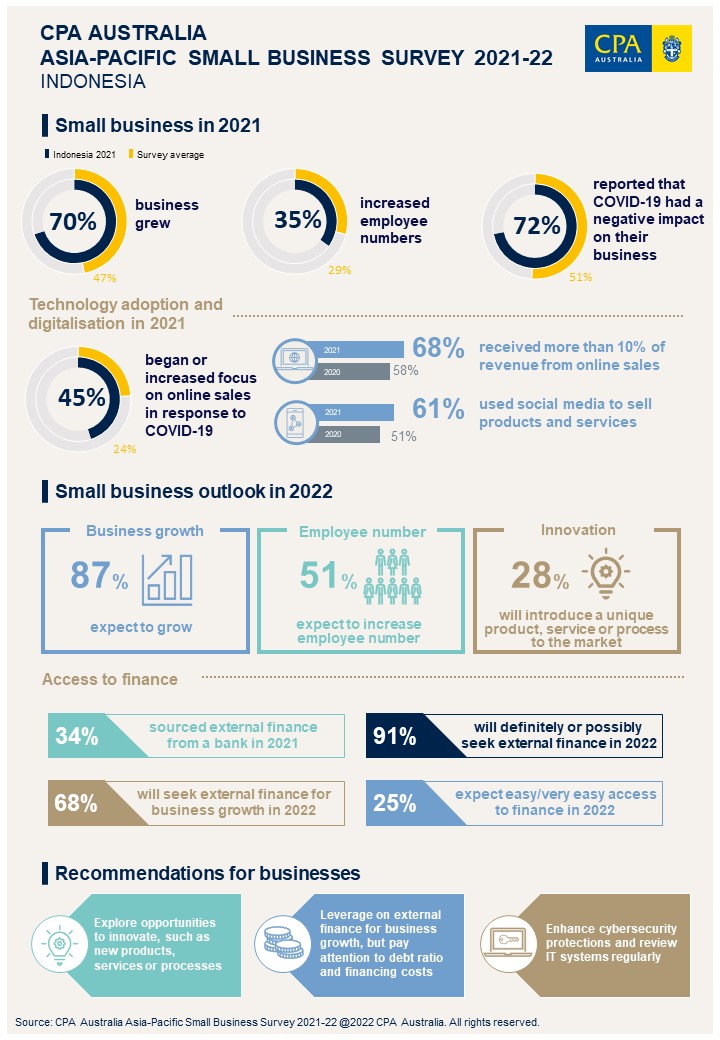

Indonesian small businesses were the second most likely of the markets surveyed to be negatively impacted by the pandemic in 2021. Seventy-two per cent of Indonesian respondents nominated COVID-19 as the most detrimental factor on their business.

Forty-five per cent of respondents said they had shifted to online sales as a response to the pandemic, the highest of the surveyed markets. Benefiting from this proactive tilt towards e-commerce, 68 per cent of respondents earned more than 10 per cent of revenue from online sales, a significant rise of 10 percentage points from 2020. Sixty-one per cent used social media to sell their products and services in 2021, up from 51 per cent in 2020.

As a result of the surge in e-commerce and digital transformation, seven in ten stated that their business grew in 2021, making Indonesia the champion of business growth in the region. This achievement was reflected in the healthy proportion of small businesses that created more jobs. Thirty-five per cent of respondents said they had hired more staff in 2021.

Dr Adi Budiarso FCPA (Aust.), Chairman of the CPA Australia Indonesia Advisory Committee and the Director of the Financial Sector Policy Centre at Indonesia's Ministry of Finance, said: "2021 was a very challenging year for small businesses in Indonesia because of the pandemic.

"Nonetheless, I am proud to see the resilience and agility of Indonesia's small businesses. The survey findings not only show their skill in sustaining business operations but also growing through the use of e-commerce. Government assistance programs such as PEN program and Rumah BUMN no doubt assisted with this."

These capabilities are translating to strong business expectations in 2022. Eighty-seven per cent of respondents expect their businesses to grow this year, making Indonesia one of the most optimistic markets surveyed. As a result, a high proportion intend to increase employees (51 per cent).

Ninety-one per cent of Indonesian respondents expect that they will definitely or possibly require external finance in 2022, the second highest result. Sixty-eight per cent will seek external finance for business growth. However, only one-quarter of respondents expect that accessing finance will be easy or very easy.

"Micro, small and medium enterprises (MSMEs) are major contributors to our economy and employment. A friendly financing environment would enable them to keep expanding. According to the survey findings, banks are their primary source of finance. New rules issued by Bank Indonesia should encourage local banks to increase their lending to MSMEs from June this year.

Looking forward, Dr Adi suggested that Indonesian small businesses focus more on innovating to maintain their competitiveness in the Asia-Pacific region, as their intention to innovate has declined since 2019. "Although many small businesses grew, they will need to bring their innovation up a notch as there is strong customer demand for new products or services."

CPA Australia recommends that Indonesian small businesses consider the following:

- Explore opportunities to innovate such as new products, services or processes.

- Leverage external finance for business growth, but pay attention to debt ratio and financing costs.

- Enhance cybersecurity protections and review IT systems regularly.

About CPA Australia

CPA Australia is one of the largest professional accounting bodies in the world, with more than 170,000 members in over 100 countries and regions, including more than 21,000 members in South-East Asia. Our Indonesian office, located in Jakarta, opened in 2011. Our core services include education, training, technical support and advocacy. CPA Australia provides thought leadership on local, national and international issues affecting the accounting profession and public interest. We engage with governments, regulators and industries to advocate policies that stimulate sustainable economic growth and have positive business and public outcomes. Find out more at cpaaustralia.com.au

#CPAAustralia

The issuer is solely responsible for the content of this announcement.