Super funds have been working for themselves when they should have been working for us. That's about to change

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

Have you ever wondered why your super fund rarely sends you mail?

It could be because it is one of the 36 funds that perform badly, or one of the six funds that perform extraordinarily badly[1]. As of mid last year those six funds[2] managed the retirement savings of 900,000 Australians.

Not that you would know it from their communications. The wonder of a system that pours a fresh 9.5% of your salary into super each year is that your fund is able to show an upward graph of the amount you’ve got saved even if it is managing those savings badly. You might think it was performing well.

Or your fund might have a more straightforward reason for avoiding mail.

The head of Australia’s biggest super fund, Australian Super with 2.4 million members, spelled it out in an appearance before the banking royal commission.

He said “a direct mail-out – a one-off direct mail-out to Australian Super’s members — costs $2.3 million[3]”.

A million here, two million there…

Chief executive Ian Silk was trying to put into context the $2 million Australian Super threw at the startup news site New Daily[4] throughout 2012 and 2013. He said the $2 million (long gone) wasn’t an investment in the financial sense of the term, but an investment in communications, “a tool to enhance the fund’s engagement with members”.

It’s an investment that will be illegal from July under the government’s proposed Your Future, Your Super[5] law, along with those rather odd TV advertisements implying improbably that unless the government lifts compulsory super contributions, people might lose their houses[6].

It will be illegal for funds to spend money on these things even if they route the payments through a third party[7] such as the super-fund-owned Industry Super Australia, as they now are.

Read more: That extra you're about to get in super, most of it will come from you, but don't expect the ads to tell you that[8]

The new laws, which flow from the royal commission and a Productivity Commission inquiry, will require every cent of super fund spending (without “any materiality threshold”) to be directed to the best financial interests[9] of members.

What’s different is the addition of the word “financial”. Previously funds were only required to act in the “best interests” of the members.

Until now (and this is an example used in the explanatory memorandum[10]) it might have been OK for a fund to spend member contributions on “well-being and counselling services, due to its preference for providing beneficiaries with a holistic retirement experience”.

Services, seats at the Australian Open

It won’t be legal after July. Spending will have to be in the best “financial” interests of members.

And the onus of proof[11] will be reversed. If challenged, funds will have to demonstrate that their decisions were indeed in the best financial interests of their members, rather than regulators demonstrating that they were not.

Which it should be. It’s our (mainly conscripted) money that they are spending. If they can’t make out a case for the way they are spending it, they might be acting as if it’s their own.

Shockingly, when in 2017 the Productivity Commission inquiry into super asked all 208 funds regulated by the Prudential Regulation Authority for information[12] about their spending and net returns and fees by asset class, 94 didn’t respond[13].

A cavalier approach to finances

Of the 114 funds that did respond, 26 left blank all of the bits of the form that asked about assets, net returns and investment management costs.

When the commission tried again the following year, 13 of the 136 funds that responded provided no information about expenses at all[14]. It was as if they either didn’t know about their expenses, or felt it was their business and no one else’s.

Time and time again the commission heard about bank-operated funds buying products from other parts of the bank at high prices.

The banking royal commission heard of hundreds of thousands of dollars spent by just one (industry) fund on corporate hospitality at the Australian Open[15].

It heard of directors of a retail fund who decided against putting their members into lower-priced products when they became available, overruling a lone director who protested[16], using capital letters

in what circumstances would it NOT be in a client’s best interest to transfer to the new pricing if it was lower than their existing pricing?

Spending on advertising would still be permitted under the draft legislation, but only where it was in the best financial interests of members. If it was aimed at grabbing members from other funds it probably would pass the test, because when funds get bigger the costs per member can shrink.

But the guidance note makes it clear that the costs per member would need to actually shrink,[17] along with the charges to members, or there would need to be a documented case prepared as to why they should have shrunk.

Read more: Yes, women retire with less than men, but boosting compulsory super won't help[18]

Vanity advertising, or advertising for a group[19] of funds, or advertising aimed at influencing public opinion[20] won’t cut it.

And nor will indifferent performance. The law will require the Prudential Regulation Authority to annually test the performance of funds against objective, consistently-applied benchmarks[21], different benchmarks for different stated investment strategies.

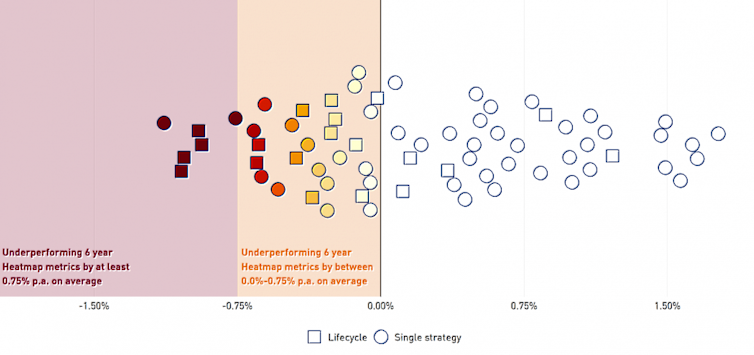

Early MySuper test results

Five-year performance as at June 30 2020, the darkest coloured funds are the poorest performers.

APRA[22]

Five-year performance as at June 30 2020, the darkest coloured funds are the poorest performers.

APRA[22]

Funds that fail the test will be required to notify their members in writing. Funds that fail two years in a row will be closed to new members.

Most of us probably have no idea that we spend more on super investment and administration fees each year than we do on gas and electricity[23] combined.

And when the performance is lousy (the difference between a good and bad fund can be $660,000[24] in retirement) we often don’t find out until it’s too late.

Our funds are about to have to work for us first, and no-one else.

References

- ^ extraordinarily badly (www.apra.gov.au)

- ^ six funds (www.apra.gov.au)

- ^ $2.3 million (financialservices.royalcommission.gov.au)

- ^ New Daily (thenewdaily.com.au)

- ^ Your Future, Your Super (parlinfo.aph.gov.au)

- ^ lose their houses (www.youtube.com)

- ^ third party (parlinfo.aph.gov.au)

- ^ That extra you're about to get in super, most of it will come from you, but don't expect the ads to tell you that (theconversation.com)

- ^ best financial interests (parlinfo.aph.gov.au)

- ^ explanatory memorandum (parlinfo.aph.gov.au)

- ^ onus of proof (parlinfo.aph.gov.au)

- ^ information (www.pc.gov.au)

- ^ 94 didn’t respond (www.pc.gov.au)

- ^ no information about expenses at all (www.pc.gov.au)

- ^ Australian Open (www.afr.com)

- ^ protested (scribepublications.com.au)

- ^ actually shrink, (parlinfo.aph.gov.au)

- ^ Yes, women retire with less than men, but boosting compulsory super won't help (theconversation.com)

- ^ a group (www.industrysuper.com)

- ^ public opinion (theconversation.com)

- ^ benchmarks (parlinfo.aph.gov.au)

- ^ APRA (www.apra.gov.au)

- ^ gas and electricity (parlinfo.aph.gov.au)

- ^ $660,000 (www.pc.gov.au)

Authors: Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University