Coface Country and Sector Risk Barometer - Q2 2023 Lost illusions and great expectations

HONG KONG SAR - Media OutReach - 13 June 2023 - The year 2023 began with great enthusiasm, but in all likelihood it will not be the year that most observers were expecting.

The 1st half of the year has reinforced some of our convictions: no, inflation will not spontaneously and painlessly return to its 2% target in developed countries; no, central banks will not "pivot" between now and the end of the year; and no, the mere lifting of health restrictions will not enable China to play the role of relay engine for the global economy. Two essential things that the market had lost sight of also came back to the fore: access to abundant, cheap energy remains central to the functioning of the global economic system, and monetary policy has more direct effects on asset valuations and financial stability than on consumer prices.The economic outlook remains closely linked to inflation trends and to the response of central banks, and our forecasts are subject to a number of downside risks, including the supply of energy and credit.

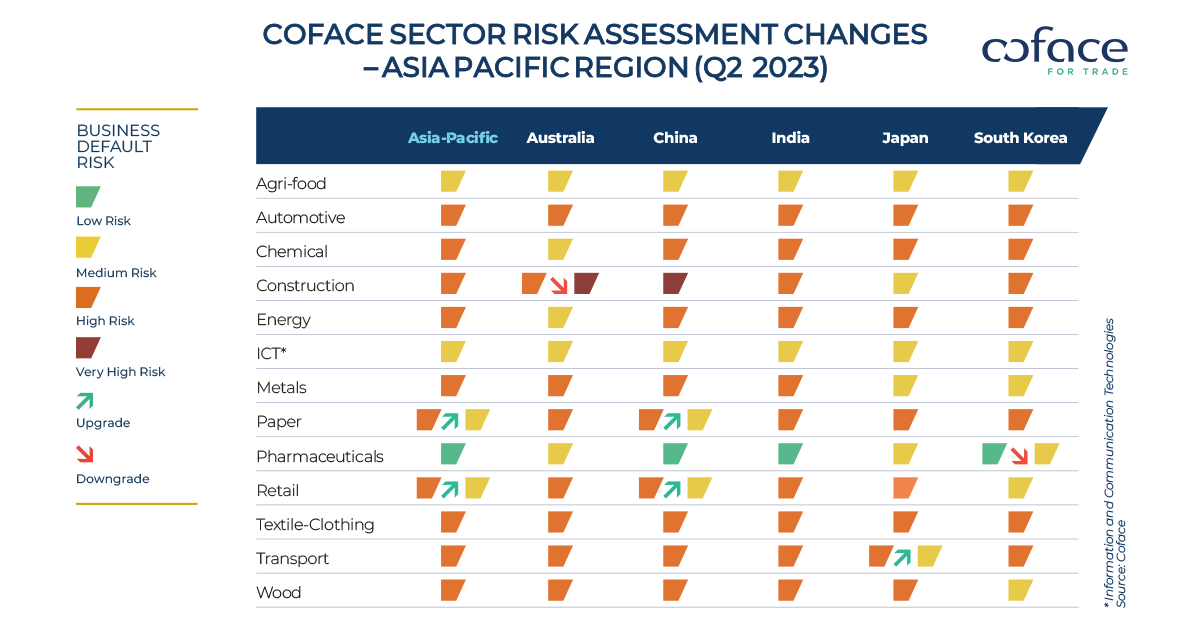

Against this backdrop, Coface made 13 upgrades and 2 downgrades revisions to its country assessments, as well as 26 changes to its sector ratings (13 reclassifications and 13 downgrades). These underline an improvement in the outlook, but an environment that remains very demanding and uncertain.

The resilience of the global economy is confirmed, but the outlook remains gloomy

The growth figures for the beginning of the year for the major economies confirmed that the spectre of recession has receded for the time being (with the exception of Germany). There are several reasons for this. Firstly, Europe has managed to avoid disruption to its energy supplies. Secondly, resilience came from a surge in consumption in North America and China. Finally, emerging economies also confirmed their resilience. All this has led us to revise upwards our growth forecast for the global economy in 2023 to 2.2%.

These various factors are reflected in our country assessments, with 13 upgrades, mainly concerning emerging countries[1] . 7 of the 13 sector upgrades concern the transport sector, which is benefiting from the upturn in tourism and the easing of tensions in supply chains.

Nevertheless, the economic outlook remains lacklustre for 2023 and beyond, particularly in the advanced economies. Our forecast (2.3% growth for 2024) suggest that global growth is unlikely to rebound significantly. The near-stagnation of the global economy is set to continue, with continued weakness in the US, a timid recovery in Europe and Chinese growth below pre-pandemic standards.

Inflation down, but not out

In the list of major risks for the months ahead, the risk of persistent inflation remains high. The "mechanical" fall in inflation in the 1er half of the year has been confirmed, as the repercussions of the conflict in Ukraine on energy prices are fading in most economies. On the other hand, signals of more entrenched inflation have also been confirmed, with core inflation stabilizing at high levels in the Eurozone, the UK and the USA.

Renewed inflationary pressures are still possible. China's recovery has not yet reached its full potential, and is likely to exert pressure on gas supplies. Meanwhile, the oil market is tighter following OPEC+'s announcements of production cuts. The organization has withdrawn the equivalent of around 3.7% of global demand from the market. For the time being, we are maintaining our forecast of an annual average of around 90 USD/barrel.

In addition to energy prices, agricultural commodities are also worth monitoring. While their decline in recent months has not necessarily been passed on to consumer prices, new upside risks are already emerging. In addition to the Russian-Ukrainian conflict, which will continue to exert pressure, the El Niño climate phenomenon seems to be on the horizon from the second half of 2023. It could influence production and prices in 2023-24, with warmer temperatures and intense water deficits in some parts of the world.

Tighter credit conditions and a further rise in business insolvencies

The effects on inflation of the unprecedented monetary tightening in recent months are still largely to be seen, particularly in terms of service prices. The latter are still rising at levels that are hardly compatible with the 2% inflation target. Nevertheless, some of the major central banks have decided to pause rate hikes, starting with the Bank of Canada, the Reserve Bank of Australia and, probably, the FED. Conversely, the Bank of England is likely to raise its rate again, and the ECB will probably be forced to hike at its next meetings.

Pauses in rate hikes should allow to assess the impact of actions taken over the past year. Indeed, the turbulence in the banking sector can raise concerns about a credit squeeze, which is already visible. The slowdown in new lending to households and businesses, which drags down domestic demand, economic activity and, ultimately, inflation, also argues for a cautious stance from central banks.

In the coming months, companies will have to contend with an adverse environment of higher prices and tighter credit conditions, as well as sluggish domestic demand. In addition, after an overall increase in margins in 2022, businesses are likely to see their operating profitability decline under the combined effects of a gradual fall in core inflation and rising unit labor costs. The sharp increase in corporate insolvencies since the start of the year in most advanced economies is likely to continue, and even intensify, over the coming months.

Emerging economies will continue to drive global growth, but pockets of vulnerability persist

While advanced economies will see their growth fall in 2024, emerging countries should accelerate, with growth of 3.9%, their strongest expansion since 2018. The main factor will be the gradual recovery of the Chinese economy, which will benefit commodity exporters. The second factor is the pause in the Fed's monetary tightening cycle.

Coface is therefore upgrading energy-exporting countries such as Saudi Arabia, Qatar, Nigeria and Kazakhstan. Meanwhile, Malaysia and the Philippines, which will benefit from the influx of Chinese tourists, are returning to their pre-pandemic assessments. It should be stressed, however, that the tightening of global financing conditions has put many countries at risk of default. Egypt was downgraded in 2022, and Ghana last February. In the same vein, we are downgrading Kenya and Bolivia this quarter.

Click here for the full Coface barometer

https://www.linkedin.com/company/coface/mycompany/

The issuer is solely responsible for the content of this announcement.

COFACE: FOR TRADE

With over 75 years of experience and the most extensive international network, Coface is a leader in trade credit insurance & risk management, and a recognized provider of Factoring, Debt Collection, Single Risk insurance, Bonding, and Information Services. Coface's experts work to the beat of the global economy, helping ~50,000 clients in 100 countries build successful, growing, and dynamic businesses. With Coface's insight and advice, these companies can make informed decisions. The Group' solutions strengthen their ability to sell by providing them with reliable information on their commercial partners and protecting them against non-payment risks, both domestically and for export. In 2022, Coface employed ~4,720 people and registered a turnover of €1.81 billion.